Improving retention and collection performance through intelligent repricing

Industry Sector: Financial Services

Business Function: Operations

A payments processor wanted to increase revenue from small and medium merchants by optimizing collections, repricing less sensitive merchants, and retaining high-value customers at risk of churn. With a fragmented data landscape of tremendous scale, they could not run the analyses necessary to act on these ideas.

Challenge

At the scale that this processor operates, there were two primary challenges:

- No effective way to prioritize or rank merchants for collections

- Limited ability to determine the best rates and fees for a merchant

Solution

-

Complete view of merchant activity — The company developed an unprecedented understanding of their customer base with a large volume of integrated data on customer activity, pricing, payment terminals, billing, fraud, and credit history.

-

Improved collections — Analysts develop statistical models to rate accounts by how likely they are to pay. High-likelihood accounts are routed to internal collections teams, while low-likelihood accounts are referred to third-party collectors.

-

New pricing strategies — Analysts perform high-scale analysis to assess the impact of different fee structures on customer retention. Sales teams use these insights to better price new accounts and reprice existing accounts to prevent churn.

Stakeholders and user groups

- Merchant Collections Team

- Financial Analysts

- Data Scientists

- Sales Teams

A financial analyst uses Foundry to go through a re-pricing exercise for merchants to ensure retention but also maximize revenue.

Impact

- Improved collection performance by filtering uncollectible accounts to 3rd parties and prioritizing highly collectible, high-value accounts. This generated millions of additional collections dollars per year projected due to the improved prioritization.

- The repricing model facilitated repricing exercises for merchants which increased retention and generated additional millions above targeted revenue.

How it’s made

- Integrated the Customer Relationship Management (CRM) system and other datasources to create a single Foundry Ontology to understand Merchant activity. Objects and relations were created for customers, their activity, pricing, payment terminals, billing, fraud, credit history, and more.

- Contour and other Foundry analysis tools used to perform analyses to determine new collections and pricing approaches. Scenario analysis of different pricing options is straight forward in Contour and Code Workbook. Vertex and Foundry Scenarios could be applied to further enable this process.

- Machine Learning models for prioritizing collections and determining repricing were implemented in Code Repositories. Foundry ML could have been considered here as well.

- The repricing application was implemented in Slate.

Implement a similar use case

This use case implements the following Pattern. Follow the link below to read more about a particular Pattern and learn how it is implemented within Foundry.

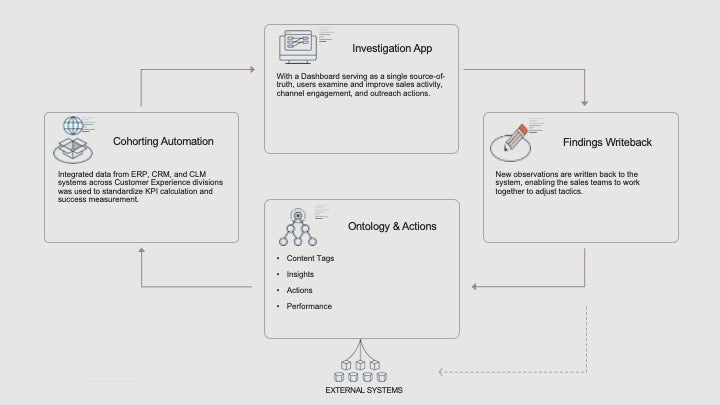

- Investigation and cohorting (used for 3 other use cases)

Want more information on this use case? Looking to implement something similar? Get started with Palantir. ↗